We recently asked nine dental support organizations what they look for in a dental practice. The DSOs we surveyed varied in size. The smallest dental group that we interviewed has eight locations, while the largest has close to 400 practice locations. There are a variety of factors they consider when evaluating a dental practice for acquisition. Here are the business development survey questions we asked the nine DSOs:

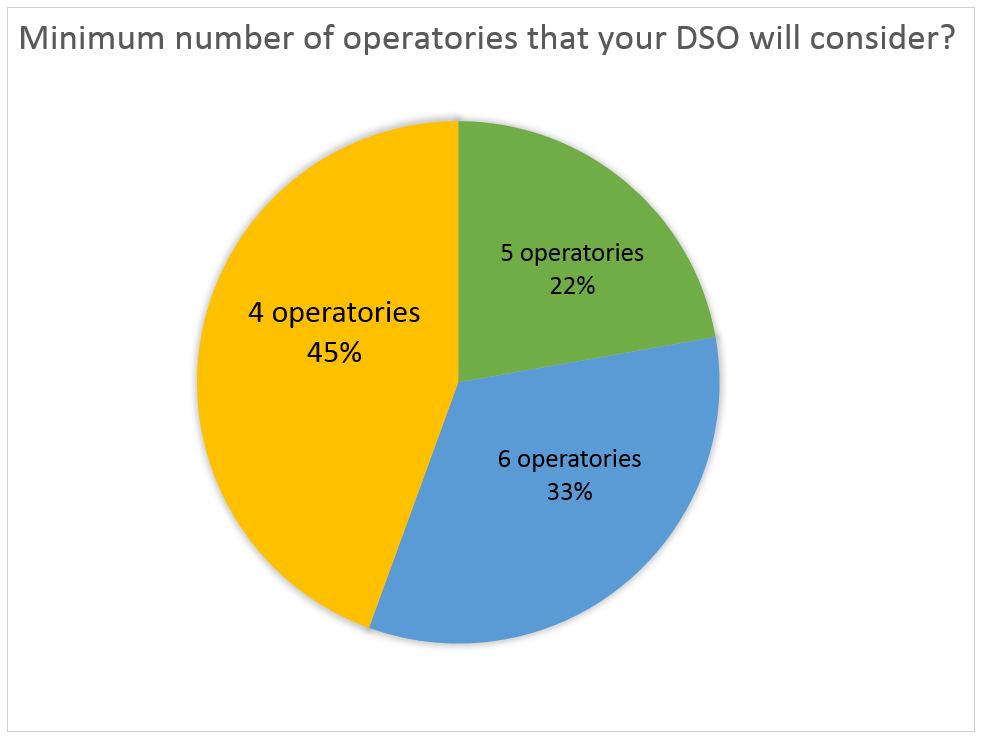

1) What is the minimum number of operatories that you will consider?

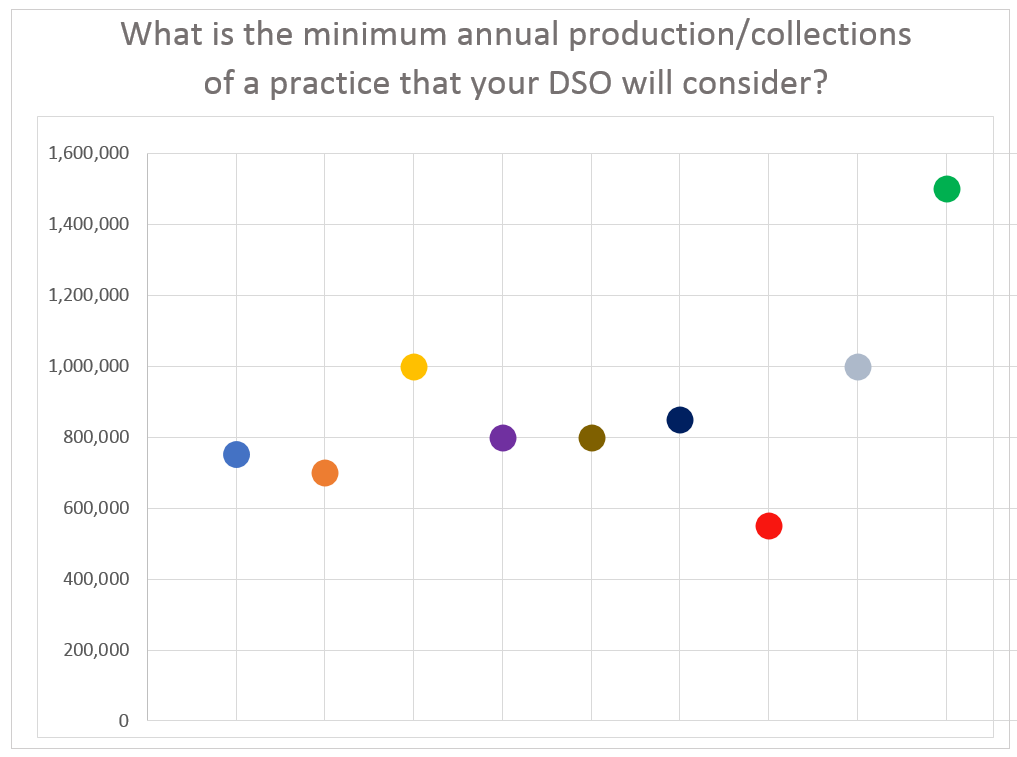

2) What is the minimum annual production/collections of a practice you would consider?

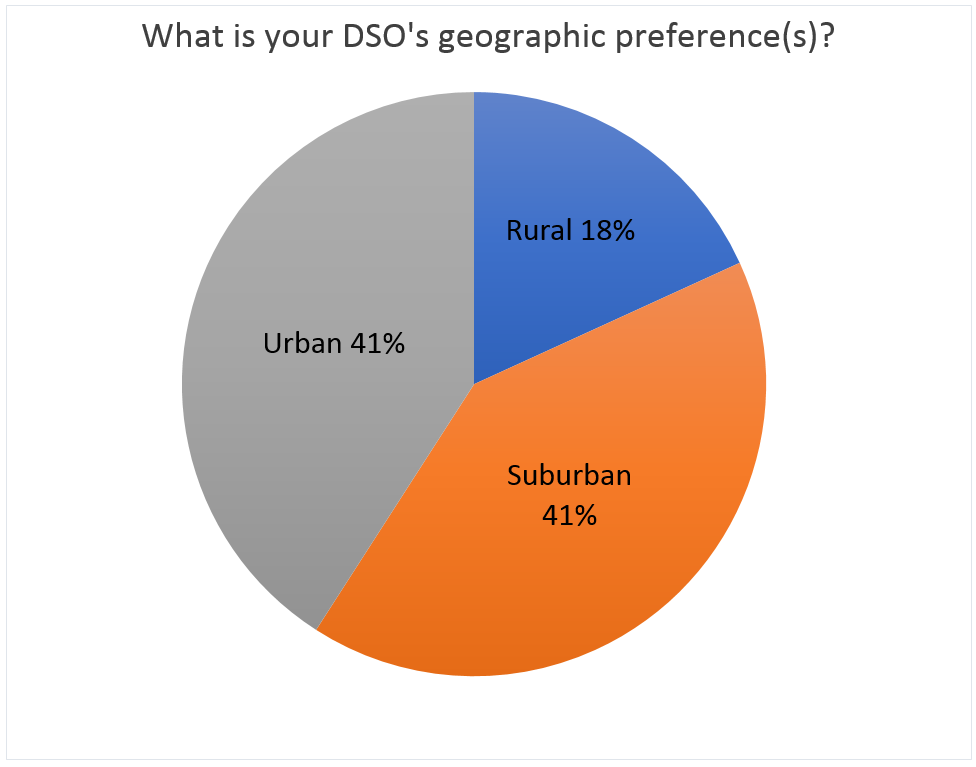

3) Choose one or more for geographic preference(s) – rural, urban, suburban?

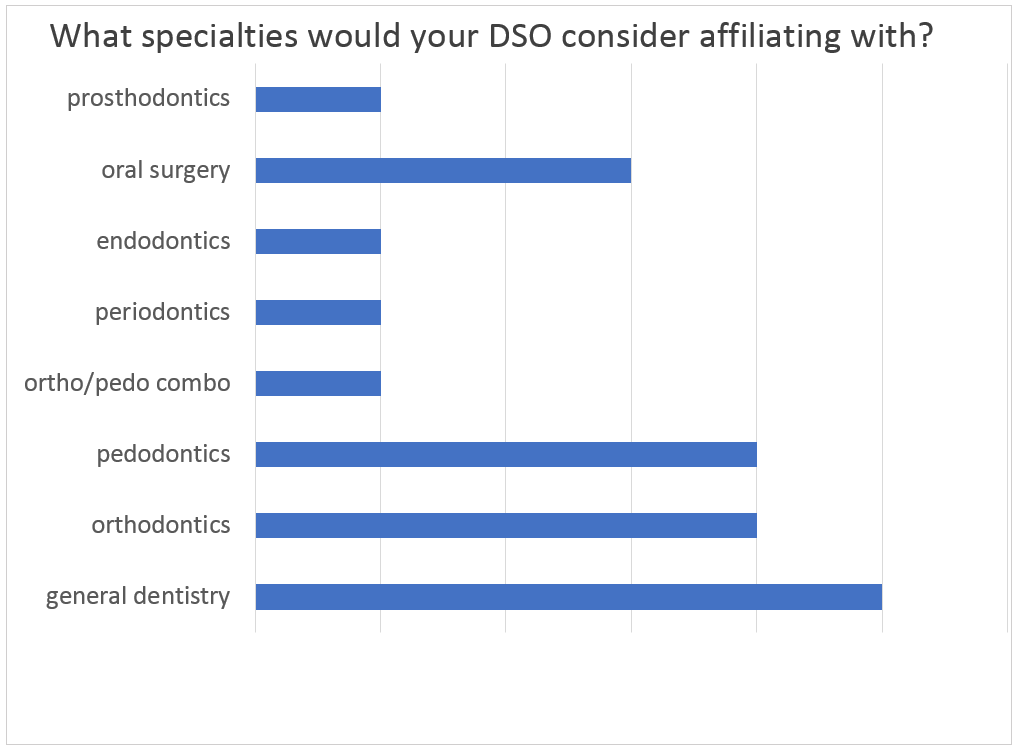

4) What specialties would you consider affiliating with?

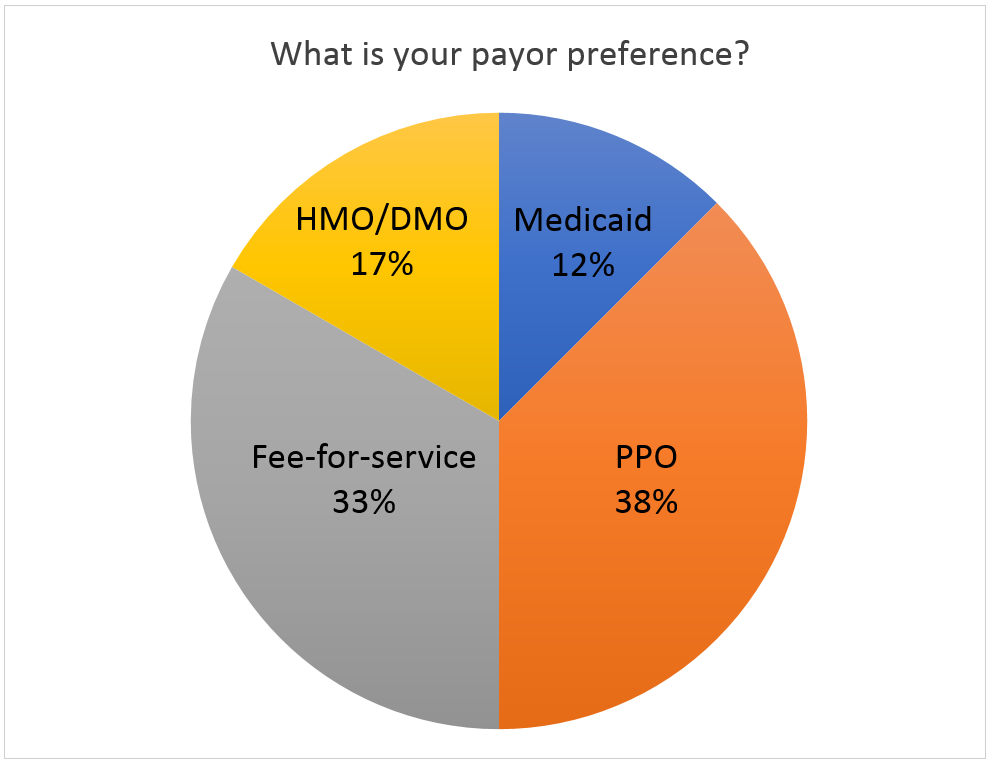

5) What is your payor mix preference? Explain what insurance you would prefer, including Medicaid, fee-for service, etc.

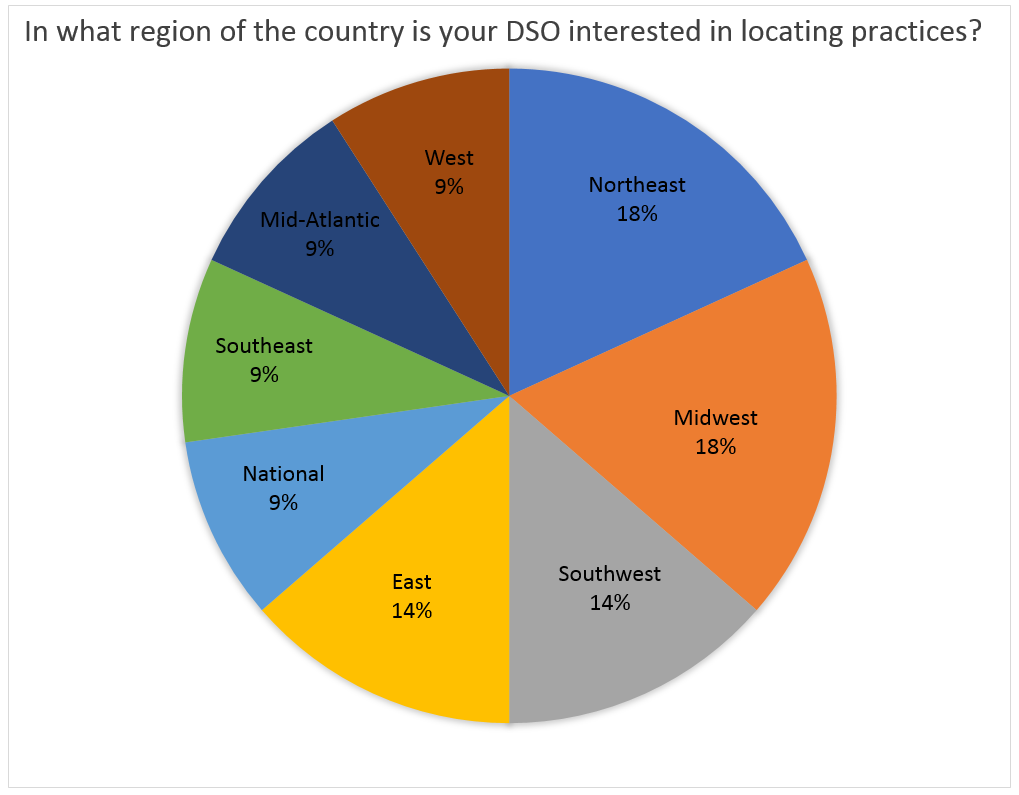

6) What part of the country are you focused in?

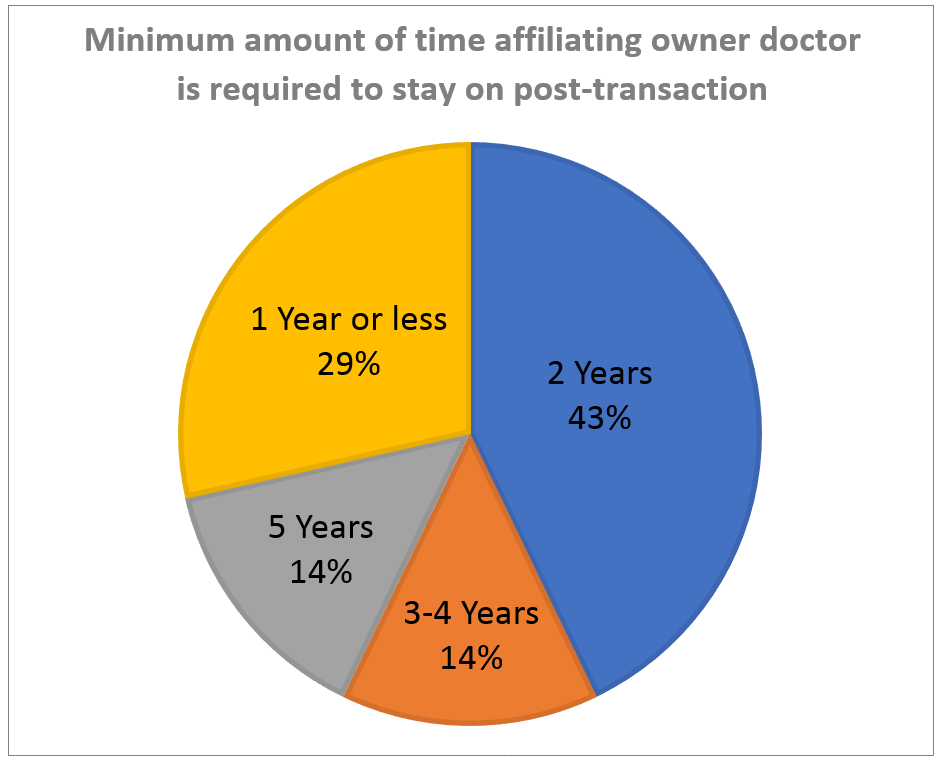

7) How long would you prefer the owner dentist to stay on post-transaction?

While this survey used a small sample of the many DSOs in the US market, it does give valuable insight into what is important to a DSO from a business development/affiliation perspective. The survey can provide insight for an owner dentist that is looking to affiliate with a dental support organization. Using the answers to these survey questions, the selling/affiliating dentist can begin to position their practice to maximize their practice value and expand their affiliation opportunities.

Many of the DSOs we spoke to would consider three or four operatories if there was room to expand to at least five operatories. Five or more operatories seems to be a typical requirement with many groups.

DSOs that were surveyed, as well as DSOs we talk to, typically look for practices with production greater than $1M. More established groups may consider practices with lower production numbers if they are geographically favorable to other practices they have under management. Several emerging groups will consider sub-$1M if there is opportunity to bring efficiencies into the practice and grow the practice above $1M in a reasonable amount of time.

As you can see from the above chart, there are DSOs looking for practices all across the United States. Speaking to several consolidators, brokers, and DSOs, California stands out as one of the least attractive states for many DSOs.

Fee-for-service and PPO lead the way with payor preferences, however the payor mix varies widely depending on geographic preferences and demographics.

The short answer is the longer the owner dentist stays on, the better. Many dental support organizations want the owner doctor to stay a minimum two years post-transaction. Most, if not all, prefer a longer time frame of three to four years, and others require five years. Owner dentists need to consider this well in advance of any type of affiliation.

There are few DSOs that would acquire a practice and then let the doctor owner immediately walk away. There were two DSOs that answered one year or less, however they prefer that the dentist stay on longer. Looking at it another way, with all things being equal, the longer an owner doctor can commit to staying on after the affiliation, the greater chance the owner dentist has of maximizing the sale price.

Thank you to 42 North Dental, CORDENTAL Group, D4C Dental Brands, DecisionOne Dental Partners, Dental Care Alliance, Montage Dental Group, North American Dental Group, Smile Brands Inc. and TruFamily Dental for participating.

If your dental group or DSO is interested in participating in our on-going survey series, please email us at info@groupdentistrynow.com.